Term Life Insurance Rates in 2025: Full Breakdown by Age, Gender, and Coverage

Updated: December 2025

Term life insurance provides affordable protection for your family's future.

Shopping for life insurance? Understanding term life insurance rates is the key to finding the best coverage at the lowest price. Term life is the most popular and affordable type of life insurance, offering pure protection for a set period (e.g., 10, 20, or 30 years) without building cash value.

In 2025, average term life insurance rates remain highly competitive, starting as low as $15–$25 per month for healthy non-smokers in their 30s seeking $500,000 coverage.

What Factors Influence Term Life Insurance Rates?

Rates are primarily determined by:

- Age (younger = lower rates)

- Health and medical history

- Gender (women typically pay less)

- Smoking status

- Coverage amount and term length

- Lifestyle factors (e.g., hobbies, occupation)

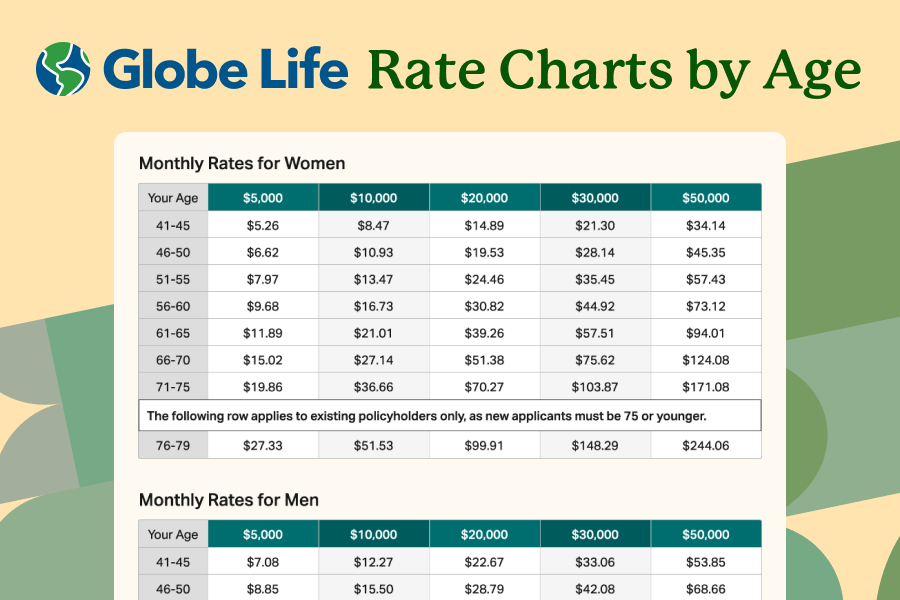

Sample term life insurance rates chart showing costs by age (Source: Industry averages 2025).

Average Term Life Insurance Rates by Age (2025)

Here are approximate monthly rates for a 20-year term, $500,000 coverage, preferred health (non-smoker):

| Age | Male | Female |

|---|---|---|

| 30 | $25–$35 | $20–$28 |

| 40 | $40–$55 | $32–$45 |

| 50 | $90–$130 | $70–$100 |

| 60 | $250–$350 | $180–$260 |

Secure your loved ones' future with affordable term life coverage.

Tips to Get the Lowest Term Life Insurance Rates

- Buy early – lock in rates while you're young and healthy

- Compare quotes from multiple top-rated insurers

- Opt for a longer term if you have young children

- Improve your health (quit smoking, maintain BMI)

- Choose no-exam options for faster (though slightly higher) rates

Smart planning leads to the best term life insurance rates.

Find Your Best Rate Today

Compare personalized term life insurance rates from top providers in minutes – no obligation.